Forex trading is like a vast ocean — it’s thrilling, full of opportunities, but it can feel overwhelming without a map. One of the first steps to navigating this market successfully is understanding the different types of forex trading styles. Each style has its own rhythm, risk level, and time commitment, so finding the one that matches your personality and goals is key to thriving as a trader.

In this guide, we’ll break down the four main forex trading styles — scalping, day trading, swing trading, and position trading — in a way that’s easy to grasp, even if you’re just starting out. By the end, you’ll have a clear sense of their pros, cons, and which might be your perfect fit. Plus, we’ll share practical tips to help you get started.

Ready to dive in? Let’s explore.

1. Scalping: The Fast and Furious Approach

Imagine a trader glued to their screen, making lightning-fast trades to snag tiny price movements. That’s scalping — a high-octane trading style where traders aim to profit from small price changes, often holding trades for just seconds or minutes.

How It Works

Scalpers execute dozens (sometimes hundreds) of trades in a single day, capitalizing on minor fluctuations in currency pairs. They rely on tight spreads, high liquidity, and advanced tools like real-time charts and Level II market data.

Pros

-

Quick profits: Small gains add up with high trade volume.

-

No overnight risk: Trades are closed before the market shuts, avoiding unexpected gaps.

-

Thrilling pace: Perfect for adrenaline junkies who love constant action.

Cons

-

High stress: Requires intense focus and split-second decisions.

-

Transaction costs: Frequent trades mean higher broker fees or spreads.

-

Time-intensive: You’re tethered to your screen for hours.

Is Scalping for You?

Scalping suits traders who thrive in fast-paced environments, have strong discipline, and can handle stress without losing focus. It’s not ideal for beginners due to its steep learning curve and emotional demands.

Pro Tip: Start with a demo account to practice scalping without risking real money. Master one currency pair before scaling up.

2. Day Trading: Seize the Day

Day trading is like scalping’s slightly calmer cousin. Traders open and close positions within a single trading day, aiming to profit from intraday price movements. Trades typically last from a few minutes to a few hours.

How It Works

Day traders analyze short-term market trends using technical indicators (like moving averages or RSI) and news events. They focus on volatile currency pairs to capture bigger price swings than scalpers.

Pros

-

No overnight exposure: You’re done by the end of the day, avoiding surprise market moves.

-

Flexibility: Trade during your preferred market session (e.g., London or New York).

-

Moderate pace: Less frenetic than scalping but still engaging.

Cons

-

Time commitment: Requires several hours of active trading.

-

Emotional discipline: Rapid price swings can test your nerves.

-

Learning curve: You need a solid grasp of technical analysis.

Is Day Trading for You?

If you enjoy analyzing markets, have a few hours to dedicate daily, and can stay calm under pressure, day trading could be your sweet spot. It’s beginner-friendly with practice but requires commitment.

Pro Tip: Focus on one or two currency pairs to build expertise. Use stop-loss orders to manage risk effectively.

3. Swing Trading: Ride the Market Waves

Swing trading is about catching medium-term price movements, or “swings,” that last from a few days to a few weeks. It’s a balanced style that blends analysis with patience.

How It Works

Swing traders use technical analysis (e.g., support and resistance levels, candlestick patterns) and sometimes fundamental analysis to identify trends. They hold trades longer than day traders, aiming for larger price moves.

Pros

-

Less time-intensive: You don’t need to monitor charts all day.

-

Bigger profits per trade: Captures larger market moves than scalping or day trading.

-

Flexible schedule: Ideal for traders with day jobs.

Cons

-

Overnight risk: Holding trades exposes you to unexpected news or gaps.

-

Patience required: Waiting for setups can feel slow for action-oriented traders.

-

Market noise: Short-term volatility can disrupt your trades.

Is Swing Trading for You?

Swing trading is great for those who want a less demanding schedule and enjoy strategic planning. It’s beginner-friendly if you’re willing to learn technical analysis and manage risk.

Pro Tip: Use a trading journal to track your setups and refine your strategy over time.

⮕ Want to boost your trading skills? Get the 7 Hidden Forex Secrets – Free PDF Download and uncover tips the pros use to stay ahead.

4. Position Trading: The Long Game

Position trading is the marathon of forex trading. Traders hold positions for weeks, months, or even years, aiming to profit from major market trends driven by economic or geopolitical factors.

How It Works

Position traders rely heavily on fundamental analysis (e.g., interest rates, GDP growth) and long-term technical trends. They’re less concerned with daily fluctuations and more focused on the big picture.

Pros

-

Low time commitment: Requires minimal daily monitoring.

-

Lower stress: You’re not glued to charts or reacting to short-term noise.

-

Big potential rewards: Captures major market trends.

Cons

-

Patience is key: profits take time to materialize.

-

Capital requirements: Long-term trades often need larger accounts to weather volatility.

-

Overnight risk: Exposure to unexpected events over long periods.

Is Position Trading for You?

If you’re patient, enjoy macroeconomic analysis, and prefer a hands-off approach, position trading could be ideal. It’s suitable for beginners with smaller accounts, provided they manage risk carefully.

Pro Tip: Stay updated on global economic news to anticipate long-term trends. Use trailing stops to lock in profits as the market moves in your favor.

Which Forex Trading Style Is Right for You?

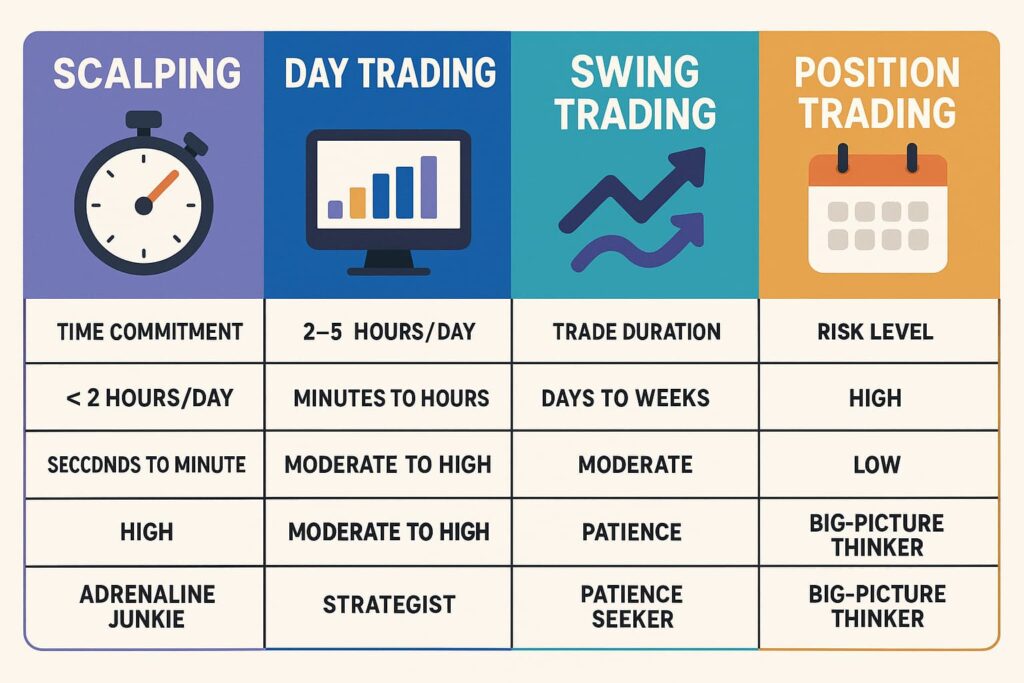

Choosing a trading style depends on three key factors:

-

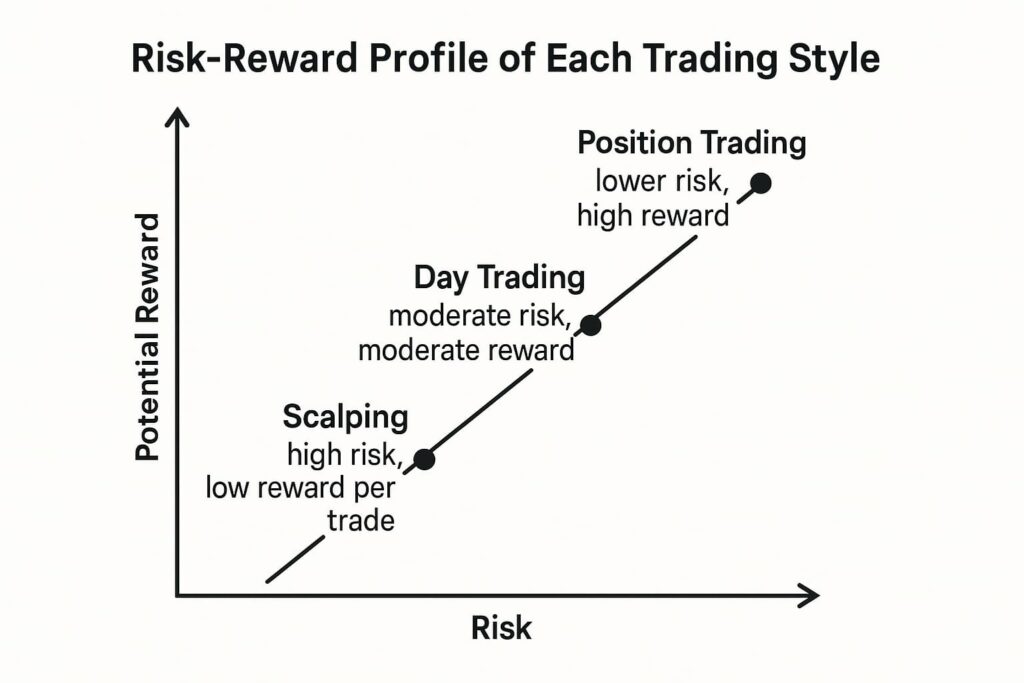

Time Availability: How many hours can you commit daily? Scalping and day trading demand more time, while swing and position trading are more flexible.

-

Personality: Are you a thrill-seeker (scalping/day trading), a strategist (swing trading), or a big-picture thinker (position trading)?

-

Risk Tolerance: Shorter-term styles involve rapid decisions and higher stress, while longer-term styles require patience and resilience.

Not sure where to start? Try this: Open a demo account and experiment with each style for a week. Track your results and see which feels most natural. There’s no one-size-fits-all — the best style is the one that aligns with your goals and lifestyle.

⮕ Ready to take your trading to the next level? Get the 7 Hidden Forex Secrets – Free PDF Download for expert insights to sharpen your edge.

Tips to Succeed in Any Forex Trading Style

No matter which style you choose, these universal tips will set you up for success:

-

Start Small: Use a demo account or micro-lots to build confidence without risking big losses.

-

Manage Risk: Never risk more than 1–2% of your account on a single trade.

-

Stay Disciplined: Stick to your trading plan, even when emotions run high.

-

Keep Learning: The forex market evolves, so stay curious and adapt.

Conclusion: Your Journey Starts Here

Forex trading offers endless possibilities, but finding the right trading style is your first step toward success. Whether you’re drawn to the fast-paced world of scalping, the strategic depth of swing trading, or the patient approach of position trading, there’s a style that fits your unique strengths.

Take your time, experiment, and don’t be afraid to learn from mistakes — every trader’s journey is a process. With the right mindset and tools, you’ll be navigating the forex market like a pro in no time.

⮕ Kickstart your trading journey with exclusive insights! Get the 7 Hidden Forex Secrets – Free PDF Download and discover strategies to maximize your profits.