The world of trading offers endless opportunities, but with so many choices, where do you begin with forex vs. options trading? These two popular strategies stand out for their profit potential. But which suits you best? This beginner-friendly guide breaks down the differences, benefits, and risks of forex trading and options trading, helping you align your choice with your goals, risk tolerance, and lifestyle. Ready to dive into forex vs. options? Let’s explore!

Ready to dive in? Let’s explore!

⮕ Get the 7 Hidden Forex Secrets—Free PDF Download at ForexCitySignal.com to supercharge your trading journey!

What Is Forex Trading?

Forex (foreign exchange) trading involves buying and selling currencies in the global market. It’s the largest financial market in the world, with over $7.5 trillion traded daily. You’re essentially betting on whether one currency (like the US dollar) will strengthen or weaken against another (like the euro).

How It Works

-

Currency Pairs: You trade pairs like EUR/USD or GBP/JPY.

-

Leverage: Forex brokers often offer high leverage (e.g., 50:1), letting you control large positions with small capital.

-

Market Hours: The forex market operates 24/5, giving you flexibility to trade anytime.

Pros of Forex Trading

-

High Liquidity: Easy to enter and exit trades due to the market’s size.

-

Low Costs: Minimal fees, often just the spread (difference between buy and sell prices).

-

Accessibility: Start with as little as $100 at many brokers.

Cons of Forex Trading

-

High Risk: Leverage can amplify losses as well as gains.

-

Complexity: Requires understanding global economics and technical analysis.

-

Time-Intensive: Constant market monitoring can be demanding.

What Is Options Trading?

Options trading involves contracts that give you the right (but not the obligation) to buy or sell an asset, like stocks, ETFs, or indexes, at a set price by a specific date. It’s like placing a strategic bet on price movements without owning the asset.

How It Works

- Call Options: Bet the price will rise.

- Put Options: Bet the price will fall.

- Premiums: You pay a fee (premium) to buy the contract.

- Expiration Dates: Options have a set timeframe (e.g., one month).

Pros of Options Trading

- Flexibility: Use options for speculation, hedging, or income generation.

- Defined Risk: Your maximum loss is limited to the premium paid.

- Lower Capital: Control large assets with less money compared to buying stocks outright.

Cons of Options Trading

- Time Decay: Options lose value as expiration approaches.

- Complexity: Requires understanding strategies like spreads, straddles, and Greeks (e.g., delta, theta).

- Higher Costs: Premiums and commissions can add up.

Forex vs. Options: Key Differences

|

Aspect |

Forex Trading |

Options Trading |

|---|---|---|

|

Market |

Currencies |

Stocks, ETFs, and indexes |

|

Trading Hours |

24/5 |

Stock market hours (e.g., 9:30 AM–4 PM EST) |

|

Leverage |

High (up to 50:1 or more) |

Moderate (margin accounts) |

|

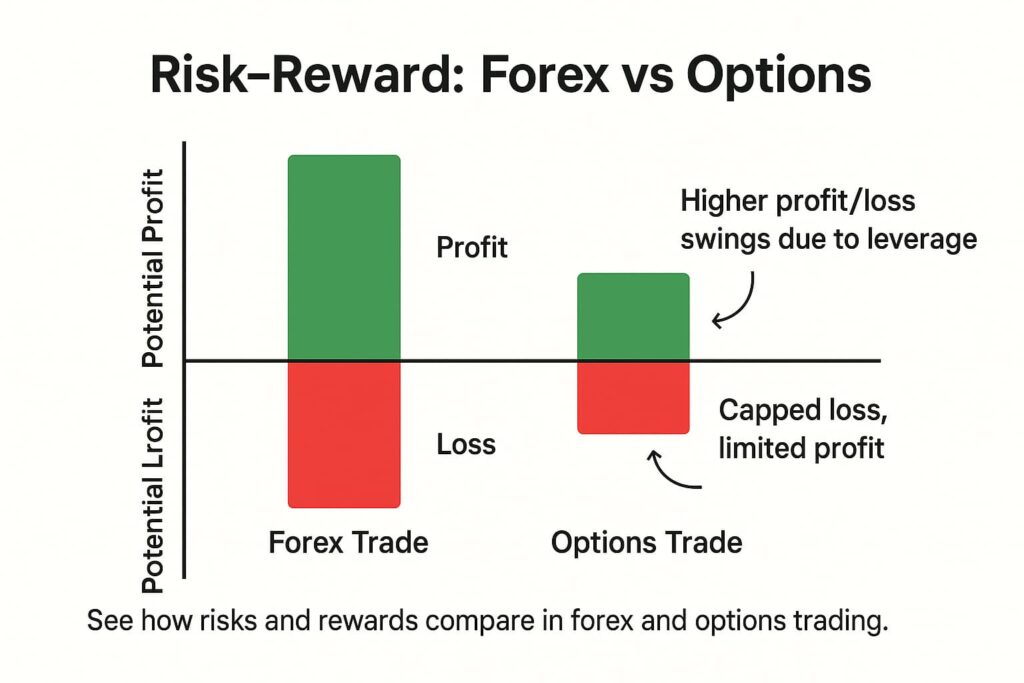

Risk |

High (amplified by leverage) |

Defined (limited to premium) |

|

Complexity |

Economic and technical analysis |

Strategies and Greeks |

|

Cost |

Low (spreads) |

Higher (premiums, commissions) |

|

Time Commitment |

High (constant monitoring) |

Moderate (depends on strategy) |

Which Forex vs. Options Strategy Suits You Best?

Choosing between forex and options depends on your goals, personality, and resources. Here’s a quick guide to help you decide:

Choose Forex If:

- You enjoy fast-paced trading and can monitor markets frequently.

- You’re interested in global economics and currency movements.

- You’re comfortable with a higher risk for potentially higher rewards.

Choose Options If:

- You prefer strategic, time-bound trades with defined risk.

- You want flexibility to trade stocks or indexes without owning them.

- You’re willing to learn complex strategies for long-term success.

Still unsure? Try paper trading (simulated trading) to test both strategies without risking real money.

⮕ Want to master forex trading? Grab the 7 Hidden Forex Secrets—Free PDF Download at ForexCitySignal.com for expert tips!

Risks to Understand Before Starting Forex or Options Trading

Both forex and options trading carry risks. Here’s what to watch out for:

- Forex Risks: Leverage can wipe out your account if trades go against you. Always use stop-loss orders.

- Options Risks: Time decay can erode your contract’s value, and complex strategies require experience.

- General Risks: Emotional trading, lack of a plan, or overtrading can lead to losses in either market.

Pro Tip: Start small, use a demo account, and never invest money you can’t afford to lose.

Tips for Success in Forex Trading or Options Trading

-

Educate Yourself: Read books, take courses, or follow trusted trading blogs.

-

Develop a Plan: Create a trading strategy with clear entry/exit rules.

-

Manage Risk: Risk no more than 1–2% of your account per trade.

-

Stay Disciplined: Avoid chasing losses or trading impulsively.

-

Use Tools: Leverage charting platforms like TradingView or MetaTrader for analysis.

Conclusion:

Whether you choose forex or options, both offer unique opportunities to grow your wealth. Forex is ideal for those who thrive in a fast-paced, global market, while options suit strategic thinkers who prefer defined risks and flexible strategies. The key to success? Education, discipline, and practice.

Ready to take the next step? Start with a demo account to test your skills, and don’t forget to grab our 7 Hidden Forex Secrets—Free PDF Download at ForexCitySignal.com to unlock expert strategies for forex success.

Which path will you choose—forex or options?

Share your thoughts in the comments below, and let’s keep the trading conversation going!